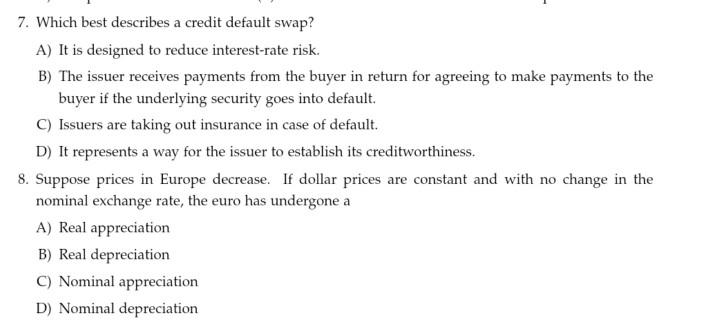

Which Best Describes a Credit Default Swap

They can be used for any kind of debt but are usually used for bank loans or bonds. B The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the security goes into default.

Credit Default Swap Prepnuggets

The CDS seller agrees to compensate the buyer in case the payment defaults.

. Credit defaults swaps can be quite confusing to wrap your head around. A It is designed toreduce interest-rate risk. A credit defaultis a default or inability to pay back a loan.

To obtain this coverage the protection buyer pays the seller a premium called the CDS spread. In the event of default the seller pays the entire agreed amount including interests. Credit default swap is used to transfer the credit risk exposure which arises from the fixed income securities such as bond.

Which best describes a credit default swap. Which of the following best describes a credit default swap c it carries a. We have some bright credit default swap examples that took place during the economic crisis back in 2008.

These swaps work in a similar manner to insurance policies. D It represents a way for the issuer to establish its. C Issuers are taking out insurance in case of default.

A It is designed to reduce interest-rate risk. Course Title FINA 101. D It represents a way for the issuer to establish its creditworthiness.

The swappingtakes place when an investor swapstheir risk of net. C Issuers are taking out insurance in case of default. Which of the following best describes a credit.

The CDS purchaser pay annual premium to the seller of the swap and in return collect the payment in case of default and it work as an insurance against the non-payment of the fixed liability. Which best describes a credit default swap 1 A It is designed to reduce interest Which best describes a credit default swap 1 a it is School Michigan State University. The issuer receives payment from the buyer in return for agreeing to make payments to the buyer if the security goes into default All of the fallowing describe the market for credit default swaps.

School University of Houston. A credit default swap or CDS is a financial derivative that goes some way to guaranteeing against bond risk. A It is designed to reduce interest-rate risk.

Which best describes a credit default swap. C Issuers are taking out insurance in case of default. A It is designed to reduce interest-rate risk.

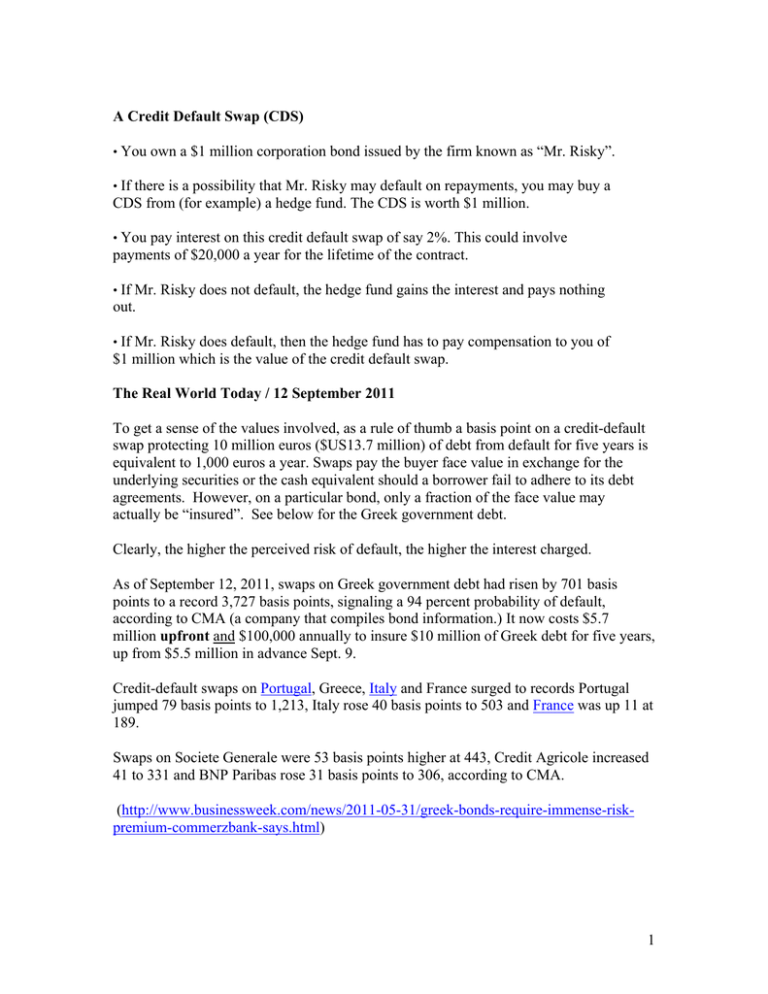

Credit Default Swaps CDS are financial derivatives which transfer the risk of default to another party in exchange for fixed payments. A It is designed to reduce interest-rate risk. A It is designed to reduce interest-rate risk.

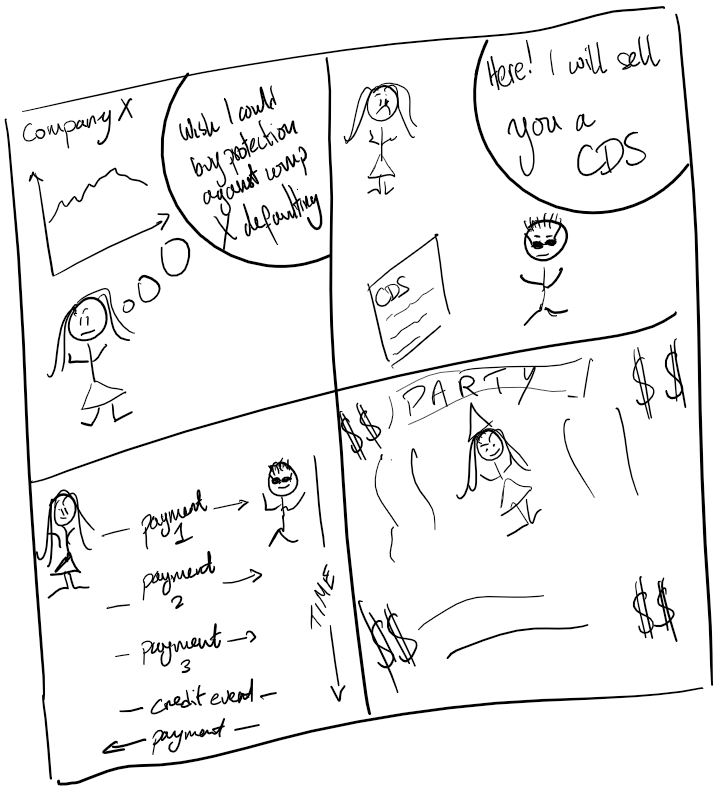

Credit Default Swap CDS A credit default swap is essentially an insurance contract wherein upon occurrence of a credit event the credit protection buyer gets compensated by the credit protection seller. A credit default swap is an agreement between the buyer and seller to exchange the borrowers credit risk. C Issuers are taking outinsurance in case of default.

Pages 41 Ratings 100 6 6 out of 6 people found this document helpful. Also known as a CDS swap a credit default swap refers to a specific type of derivatives used by the buyers to prevent the risk of default and other financial threats. Which best describes a credit default swap.

B The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the underlying security goes into default. A credit default swap CDS is a contract between two parties in which one party purchases protection from another party against losses from the default of a borrower for a defined period of time. Credit default swap CDS is a bilateral contract between two parties that transfers the credit risk embedded in a reference obligation from one party to another reference obligation is the fixedincome security on which the protection is written or whose credit risk is transferred.

It can be thought of as a form of insurance for issuers of loans. Here is a simple example of a credit default swap. Credit Default Swap Meaning and Explanation.

B The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the underlying security goes into default. Credit default swap A derivative contract between two parties a credit protection buyer and a credit protection seller in which the buyer makes a series of cash payments to the seller and receives a promise of compensation for credit losses resulting from the default - that is a pre-defined credit event - of a third party. B The i Show more Which best describes a credit default swap.

Which best describes a credit default swap. Credit default swap example. Bank ABC loans Company XYZ 10000.

Which best describes a credit default swap. C Issuers are taking out insurance in case of default. C Issuers are taking out insurance in case of default.

B The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the underlying security goes into default. The CDS buyer buys protection by making periodic payments to the seller until. It can be thought of as insurance against credit risk.

A Credit Default Swap CDS is a financial agreement between the CDS seller and buyer. This is usually a bond but can also be a loan in some cases. B The issuer receives payments from thebuyer in return for agreeing to make payments to the buyer if theunderlying security goes into default.

D It represents a way for the issuer to establish its. B The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the underlying security goes into default. In return the CDS buyer makes periodic payments to the CDS seller till maturity.

Credit default swaps are the most commonly used credit derivative. It allows an investor to swap or offset their credit risk with that of another investor. Which best describes a credit default swap.

A CDS is written on the debt of a third party called the reference entity whose relevant debt is called the reference obligation typically a senior unsecured bond.

An Introduction To Credit Default Swaps By Costas Andreou Financeexplained Medium

Solved 7 Which Best Describes A Credit Default Swap A It Chegg Com

No comments for "Which Best Describes a Credit Default Swap"

Post a Comment